Augusta Precious Metals Review

In this Augusta Precious Metals review we’ll teach you how to own your own vault of gold. One that you can even go visit!

We’ll learn more about how people use Augusta Precious Metals and their services to safely invest in physical assets like gold and silver, the fees associated with doing so, storage plans and more.

Note: While I’ve done research on IRAs, gold and Augusta Precious Metals – none of this should be considered financial advice, tax advice or investment advice. The decision to buy precious metals or open an account with Augusta is entirely your own.

What is Augusta Precious Metals?

Augusta Precious Metals allows users to buy and sell precious metals. Their main mission is to help people understand the natural diversification benefits of gold and silver.

People can buy precious metals directly from Augusta and have them delivered to their house. However, the most popular option is to set up a gold and silver IRA.

These alternative retirement plans offer a secure, and tax advantageous investment in physical gold, silver and IRA approved metal coins. For security reasons, and to comply with IRS/IRA withdrawal requirements, these metals are held in a secure and insured vault.

Augusta Precious Metals Review

Augusta Precious Metals Review

If you can meet the minimum investment requirement, Augusta Precious Metals is the premiere company for opening a gold and silver IRA. The company has an excellent track record, high rating with the Better Business Bureau, low fees and an easy, guided set up process.

Overall

-

Customer Service

-

Fees

-

Minimum Investment

-

Education & Onboarding

Pros

- Highly rated and trusted

- Plenty of guidance and educational material

- Low fees

- Insured vaults

- Easy Roll over and/or set-up process for IRAs

Cons

- High minimum investment of $50,000

Before We Dive Deep

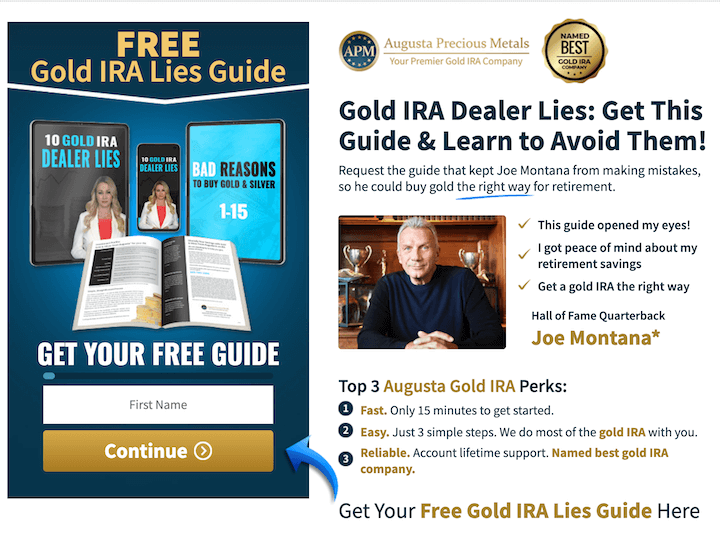

This Augusta Precious Metals review will go into the details of some of the products that Augusta Offers. However, Augusta themselves has a lot of educational resources.

Perhaps the best way to learn more is by downloading their free guides. After you read their information, getting set up only takes 15 minutes and is primarily done through the phone.

A representative will educate you, help you open an IRA best suited for you and then help you make your purchase of gold and silver.

What is Augusta Gold and Silver IRA?

The Augusta Gold and Silver IRA is a self-directed Individual Retirement Account that allows users to invest in Gold, Silver and precious coins in a tax advantageous way.

Investing in precious metals through a traditional IRA allows you to make purchases in a tax-deferred manner. Buying precious metals through a Roth IRA gives users a tax-free option for buying gold, as they are buying with post tax dollars.

The catch for both structures is that penalty-free distributions can not be taken from the IRA until an owner is 59.5 years of age or older. Exceptions apply for qualifying life events.

Investing in physical precious metals is a great way to diversify your funds. Gold and other precious metals have a low correlation to stocks and tend to be more stable in times of market volatility and downturns.

What Does it Mean To Hold Precious Metals in an IRA?

When you buy precious metals through Augusta’s Gold and Silver IRAs you own physical bars, bullion and coins. Not paper certificates.

When you simply buy precious metals through Augusta, not in an IRA, the metals can be shipped directly to your house. However, because an IRA has withdrawal age requirements, the metals must be stored in Augusta’s state of the art, IRS compliant vault partners.

The vaults are completely insured, and available in the following cities: Salt Lake City, UT; Los Angeles, CA; Las Vegas, NV; New York, NY.Nampa, ID; Las Vegas, NV; South Fargo, ND; Wilmington, DE, Shiner, TX; Dallas, TX; Bridgewater, MA; and New Castle, DE.

Owners of an Augusta Gold and Silver IRA can even set up times to visit the facility and see their physical metals.

How Much of Your Portfolio Should Be In Precious Metals?

It is ultimately up to each person to decide how much of their portfolio should be held in precious metals.

Experts have recommended between 2-10%. However, recommendations are across the board. It is impossible for anyone to predict the future and decide how much, or which, precious metal to buy.

Always consult your own legal, financial and/or tax advisor.

Can Other Retirement Accounts and 401k’s RollOver into Augusta Precious Metal IRAs?

Yes, you can roll over funds from other IRAs and 401k’s to fund your Augusta Precious Metals IRA. In fact, this is the most common way that Augusta IRA’s are funded. A customer service representative will help you with 95% of the paperwork needed to rollover a previous IRA and set up a new precious metals IRA with Augusta.

How Do You Buy Gold or SIlver with Augustas Precious Metals?

The first step to buying gold and silver with Augusta is checking out their materials and then making an appointment with a customer service rep.

From there, you will receive current economic education from the Augusta rep. If you decide to move forward the Augusta team will handle 95% of the legwork to set up your new IRA and handle any roll overs from previous retirement accounts.

Once your account is set up you can further decide which precious metals to buy, where to store them, and how to allocate your portfolio.

The final step is to confirm your purchase, and purchase price, over a recorded line with the Augusta Representative.

From there, you will have a vault of gold, silver and coins 🙂

Is it hard to sell or liquidate your precious metals?

Augusta stays with their IRA customers throughout the lifetime of their purchase. For that reason, they offer buy back and liquidation services that are fast and easy.

Most times, customers can simply call up their representative and have that representative sell the stored gold. The cash is then sent to the customer’s account.

Please note, always consult a tax accountant and lawyer before making any sales/closures of an IRA to avoid penalties.

Augusta Precious Metals Minimum Investment

Augusta Precious Metals has a $50,000 minimum investment requirement. This goes both for buying precious metals directly on the spot market and opening an IRA and having the metals stored in a facility.

This minimum investment is quite a bit higher than other IRA partners. However, if you can meet the minimum requirements, Augusta offers lower fees and often more competitive initial prices than competitors, which may have lower minimums.

Augusta Precious Metals Fees

Augusta Precious Metal IRA fees are very straight forward. There is a one time $250 set up fee that includes the application fee, non-government storage and custodian fee.

From there there is an annual fee for custodian maintenance and non-government storage of $200 a year.

Augusta Better Business Bureau – BBB

Augusta Precious Metals has the highest A+ rating from the Better Business Bureau (BBB).

They also have extremely high crowdsourced ratings on a variety of other social platforms and consumer protection sites.

Augusta Precious Metal Complaints

When researching this Augusta Precious Metals review, I couldn’t find many (or any?) complaints about when looking at websites like Consumer Affairs and trust link.

As a researcher, I believe one of the biggest drawbacks is the high minimum investment of $50,000. However, everyone seems to rave about the customer support, educational resources and experience once onboarded.

If you can make it to the minimum investment, Augusta is the Gold IRA to consider.

Augusta Gold IRA Scam

Augusta is perhaps the most reputable company to use to invest in precious metals. While anything is always possible, I couldn’t uncover any scams around their company. In fact,

Augusta even has info that helps users detect gold IRA scams from other Gold IRA dealers.

Conclusion – Is Augusta Precious Metals Legit?

Augusta Precious Metals is incredibly legit for buying gold, silver and coins. It also offers an excellent IRA service with secure, compliant and insured storage.

If you are looking to invest in precious metals and have the $50,000 minimum investment to do so, Augusta is a great alternative.

You can get started by checking out some of their materials and setting up a call with a customer service representative.

Thanks for reading our Augusta Precious Metals review!

Related Articles:

![What Is The Safest Way To Store Crypto? [2023]](https://www.peerthroughmedia.com/wp-content/uploads/2023/01/SAFEST-WAY-TO-STORE-CRYPTO-768x432.jpg)